5 Types of Adjusting Entries

By March 31 20X1 half of the rental period has lapsed and financial statements are to be. An interest expense is generally not recorded by the business during the course of the financial year.

Types And Rules For Adjusting Entries Professor Victoria Chiu Youtube

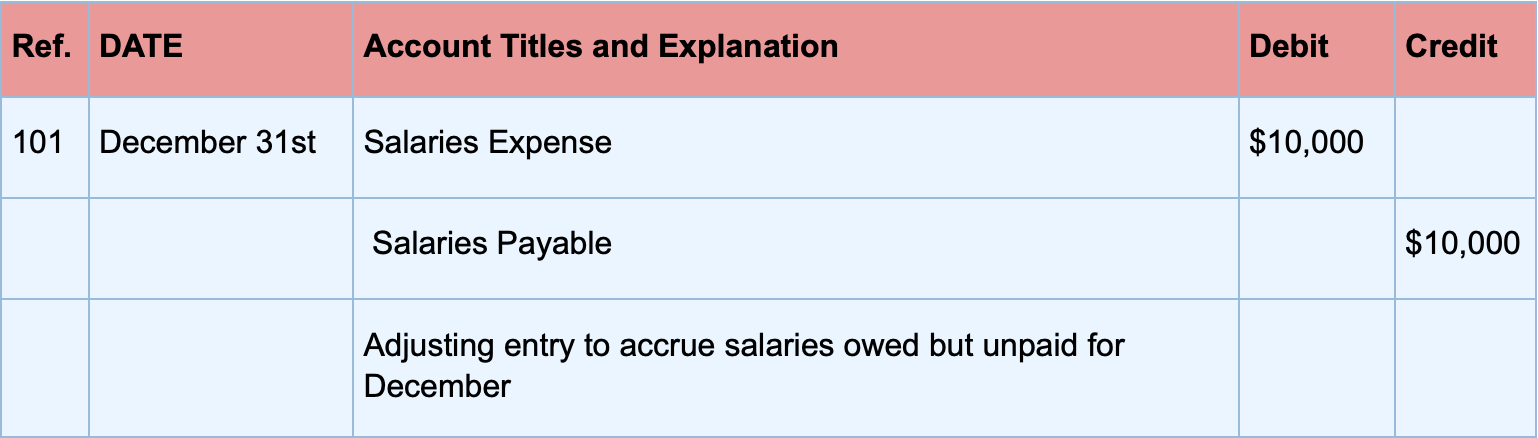

For the month of December this is the information.

. It is for this reason that companies then need to make a year-end adjusting entry to record interest expense for the year as it does for other accrued expenses such as rent or salaries. The total 40200 is shown on the credit side of the cash book bank column as payment. 2 Adjusting Entry.

Read more which are classified as the initial recordings manual payments and accrued wages. Transaction entry is on a cash basis and accrual basis. Here are descriptions of each type plus example scenarios and how to make the entries.

The remaining 6000 amount would be transferred to expense over the next two years by preparing similar adjusting entries at the end of 20X2 and 20X3. Once the balances are equal businesses need to prepare journal entries for the adjustments to the balance per books. An accrued revenue is the revenue that has been earned goods or services have been delivered while the cash has neither been received nor recorded.

How can accounting errors affect your business. The revenue is recognized through an accrued revenue account and a receivable account. Adjusting entries are required at the end of each fiscal period to align the revenues and expenses to the right period in accord with the matching principle in accounting.

The original copy of this receipt is given to the customer while the seller keeps the other copy for accounting purposes. When goods are sold to. Accounting errors can throw a major wrench in your plans if they go unnoticed.

The type of the options parameter in the function signature is always given as map. After adjusting the balances as per the bank and as per the books the adjusted amounts should be the same. When goods are purchased.

Types Examples 548 Tax Structure and Liability of Business Partnerships 704 Accounting Journal Entries for Partnerships-Investments. A typical example is credit sales. When reconciling balance sheet accounts consider monthly adjusting entries relating to consolidation.

When goods are returned to supplier. Option names defined in this specification are always strings single xsstring values. After making applicable deductions the departments may do weekly biweekly and monthly basis payments.

The key of the entry is called the option name and the associated value is the option value. If they are still not equal you will have to repeat the process of reconciliation again. A few ways might include incorrect statements that lead to further complications bills or payroll going unpaid or portraying a false picture of your financial health.

The entries in the map are referred to as options. These records are raw. Journal entries in a perpetual inventory system.

When expenses such as freight-in insurance etc. This has been a guide to payroll accounting and its meaning. 1151 Understanding the Post Process for Journal Entries in a Foreign Currency After you enter review and approve foreign currency journal entries you post them to the general ledger.

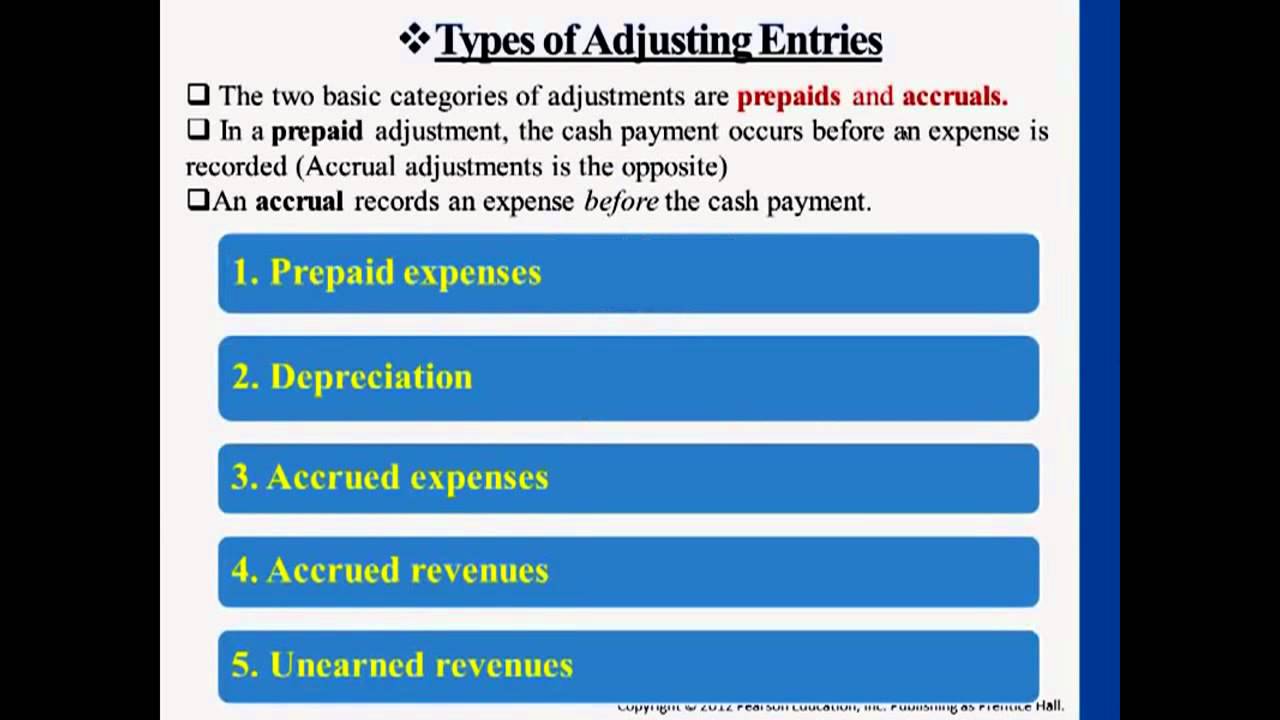

Although option names are. Prepare an adjusted trial balance 6. In general there are two types of adjusting journal entries.

Read more entries from a customer and other cash payments have been done which is an expense for the company. Assume a two-month lease is entered and rent paid in advance on March 1 20X1 for 3000. It has 3 major types ie Transaction Entry Adjusting Entry Closing Entry.

The set of journal entries involved starting from purchase to sale of goods under perpetual inventory system is given below. Analyze and record transactions. The Basics of Partnerships.

For the sake of our example Company XYZ adjusts their accounts at the end of every month through the double-entry bookkeeping method. In the ledger the wages account is debited by 11320 the transport account by 4180 the stationery account by 8660 the staff tea account by 2640 and the. Prepare adjusting entries at the end of the period 5.

This accrued expense is known as interest payable. Now that we know the different types of adjusting entries lets check out how they are recorded into the accounting books. In the first step of the accounting cycle youll gather records of your business transactionsreceipts invoices bank statements things like thatfor the current accounting period.

The five types of adjusting entries. The post program selects unposted journal entries from the F0911 table posts them to the F0902 table and then updates the transaction in the F0911 table with the posted code P posted. If making adjusting entries is beginning to sound intimidating dont worrythere are only five types of adjusting entries and the differences between them are clear cut.

Option values may be of any type. Intercompany transactions include adjusting entries for profit elimination relating to general ledger accounts like intercompany revenues accounts receivable fixed assets inventory accounts payable and cost of sales. Illustration of Prepaid Rent.

When the cash is received at a later time. 10 common types of errors in accounting. When a cheque for 40200 is issued to the petty cashier the entries made in the main cash book are.

Types of Adjusting Journal Entries 1. Adjusting Entries Why Do We Need Adjusting Journal Entries. 5 Examples for Adjusting Entries.

When you generate revenue in one accounting.

Bookkeeping Adjusting Entries Reversing Entries Accountingcoach

Adjusting Entries Meaning Types Importance And More

No comments for "5 Types of Adjusting Entries"

Post a Comment